“Eight, sir; seven, sir;

Six, sir; five, sir;

Four, sir; Three, sir;

Two, sir; one!

Tenser, said the Tensor.

Tenser, said the Tensor.

Tension, apprehension,

And dissension have begun.”

―Alfred Bester,The Demolished Man

Higher debt / interest payments squeeze out other spending. Debt payments come first, or the entity defaults on its debts and enters bankruptcy--a bankruptcy that tends to bankrupt the lenders who will be lucky to collect pennies on every dollar they lent out.

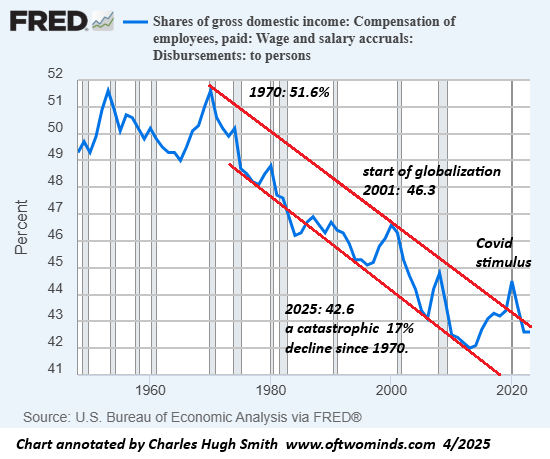

Households are going to have a hard time servicing debt and spending more as rates rise, for wage earners' share of the economy has been in a freefall for 50 years. Less income + higher debt service payments = lower discretionary income to spend + inability to borrow more money to spend = recession.

https://www.oftwominds.com/blog.html

The derivatives market is, in a word, gigantic—often estimated at over $1 quadrillion on the high end. How can that be? Largely because there are numerous derivatives in existence, available on virtually every possible type of investment asset, including equities, commodities, bonds, and currency. Some market analysts even place the size of the market at more than 10 times that of the total world gross domestic product (GDP).

What is a Crony Capitalist network expected to do except manipulate States to bail them out? And how best can this be accomplished without Plebian Resistance? Climate Change first, Corona Virus second, and nuclear War real or simulated. Already the mis-leaders demand we suffer as much as necessary until the Ukraine and indeed Russia herself is engorged in the stomach of Phynance.

Technocracy is a thruway. A Roman road engineered to conquer. If injections kill millions slowly the biological data is invaluable. Ideas too can be seeded- Meme war. Doubt,

Richard Seager will enjoy getting a mention.

Almost amusing the amount of debt.

Talk about funny money.

Governments should not be allowed to borrow money with interest.